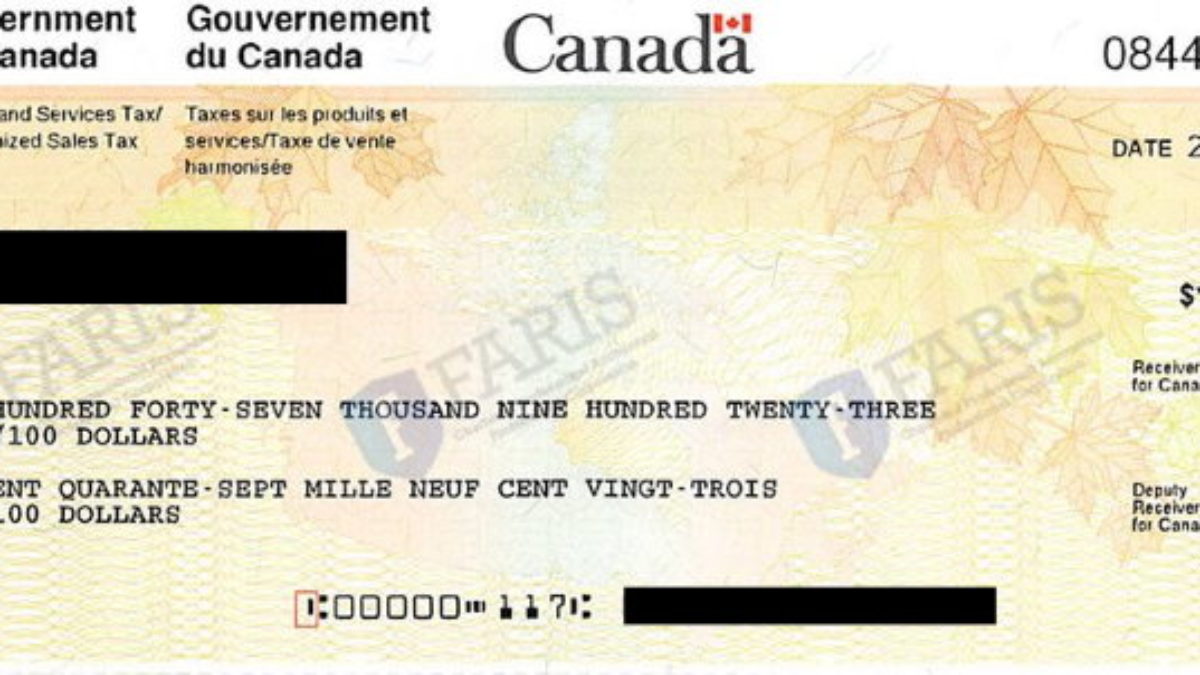

You may be required to confirm some information about your previous year's tax return, such as whether you received a refund, or what your total approximate income was. When the representative answers, tell them you want to change your address, and answer their questions. A Canadian tax return refers to the obligatory forms that must be submitted to the Canada Revenue Agency (CRA) each financial year for individuals or.When you call, select option * key - Change your address and then enter your social insurance number.Confirm your SIN number be pressing 1, or correct it by pressing 2.Level 1 will allow them to be given information but not make changes whereas a Level 2 authorization will allow them to request changes be made on your behalf. You will specify the level you want to give the representative. There are two levels of authorization that you can assign a representative to work on your behalf.You can submit an authorization for someone to represent you online, by mail, or by allowing a representative to be authorized on your behalf. Canada Recovery Sickness Benefit (CRSB) Canada Emergency Response Benefit (CERB) Canada Emergency Wage Subsidy (CEWS) Canada Emergency Rent Subsidy (CERS) Canada Recovery Hiring Program (CRHP) Payroll deductions online calculator. If you are doing this for your business, you will need to have a representative work on your behalf. the 31st day after you file your returnįor more information, see Prescribed interest rates.Correct your address over the phone.The calculation will start on the latest of the following 3 dates: The CRA will pay you compound daily interest on your tax refund for 2020. It usually takes four to six weeks before you receive your refund. have any outstanding GST/HST returns from a sole proprietorship or partnership Once you file your tax return, CRA will review and process it.have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments.have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act.The CRA may keep some or all of your refund if you: Whether it is at tax filing time or year-round, there are many advantages to signing up for and using My Account. If you use direct deposit, you could get your refund faster. More and more, the Canada Revenue Agency is turning to its online platform, called CRA My Account, to communicate with taxpayers and help them manage their tax files.

See Review of your tax return by CRA for more information. My managers and coworkers were all extremely polite and behaved with utmost decorum, the work culture around the office was positive and friendly. We may take longer to process your return if we select it for a more detailed review. Canada Revenue Agency is a great employer in that they assign specific tasks with sufficient time to complete them. Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return. These timelines are only valid for returns we received on or before their due dates.

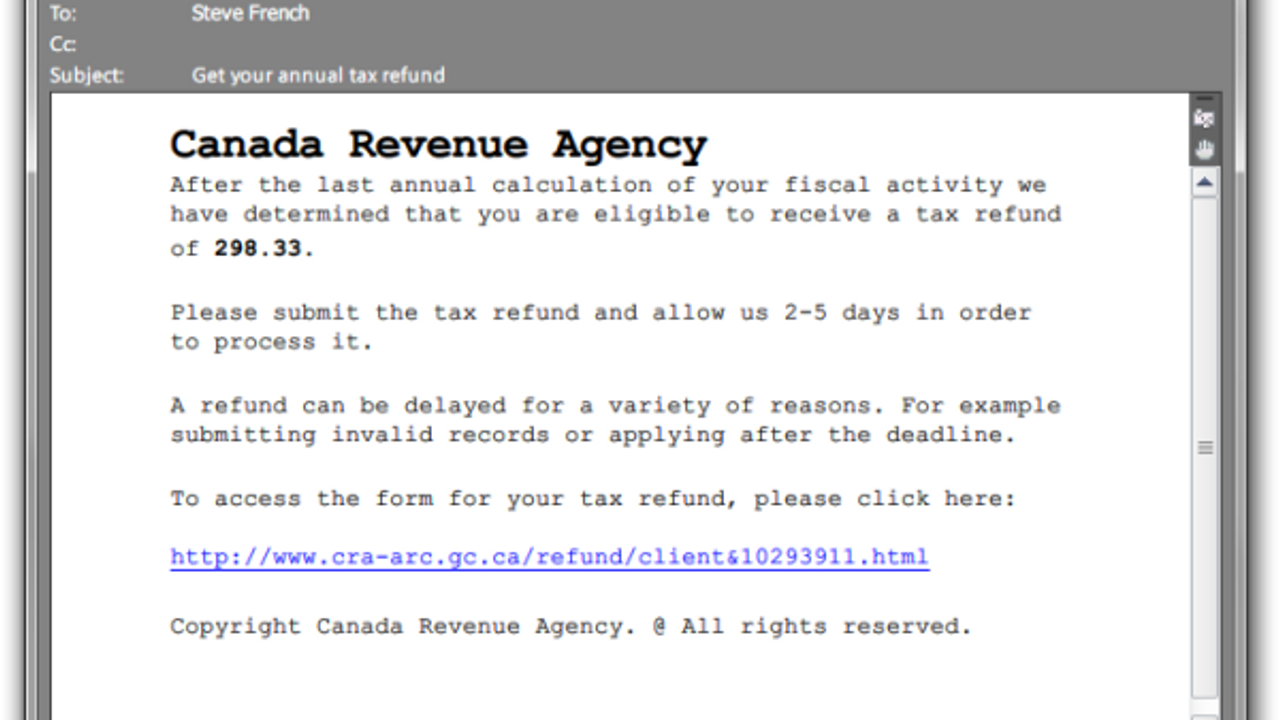

Residents who believe they have received a potential scam call or. The Canada Revenue Agency's goal is to send your refund within: 1-86 if the call you received was about a government program such as employment insurance or Canada Student Loan debts. How you file affects when you get your refund

0 kommentar(er)

0 kommentar(er)